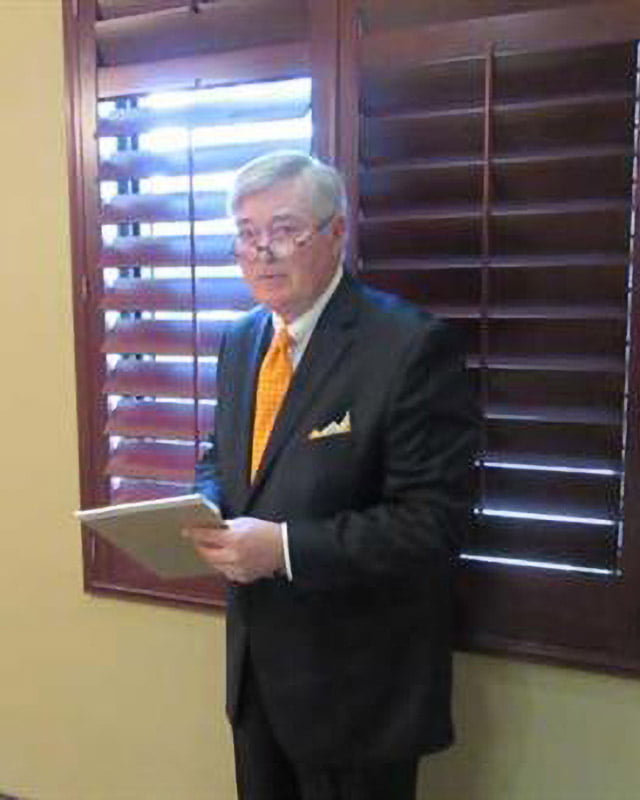

Our clients suffered damage to their home during Hurricane Ian. When they submitted their claim, they were denied. They hired us and our attorney, Louis Meyer, was able get them what they were rightfully owed for their damages – $137,000!

OVER

OVER

$ 1 Billion

WON FOR OUR CLIENTS

Your Leading Insurance Claim and Disputes

Attorneys for Over 25 Years

25+

Years

EXPERIENCE

Who We Are

The Morgan Law Group is a national law firm handling property damage insurance claims, personal injury matters and business litigation disputes. Our attorneys have over 25 years of experience with a proven track record of success, having recovered over a billion dollars in compensation for our clients.

$2.8M

Car Accident

Our client was involved in a car accident that resulted in serious injuries and extensive property damage.

$500,000

Personal Injury

We represented a client who suffered a traumatic brain injury in a car accident caused by a negligent driver.

$1.2M

Insurance

We successfully fought for our client’s rights after their insurance company denied coverage for a significant water damage claim.

$750,000

Personal Injury

Our client suffered serious injuries in a slip and fall accident caused by a property owner’s negligence.

Our client who suffered damage from Hurricane Ian was offered only $20,000 for his claim. After hiring us, our attorney, Karina Miralda, was able to secure a $200,000 settlement for him!

Our client suffered wind damage to their home and their claim was denied before hiring our firm. Our attorney, Louis Meyer, was able to successfully reopen their denied claim and get them a settlement of $110,000!

Our attorneys, Daniel Castro and Karina Miralda, secured a victorious outcome in trial on behalf of our client. Our client suffered damage from Tropical Storm ETA and her insurance company originally denied the claim.

Our Miami based attorney, Eddy Franca, won a settlement of $775,000 for a Homeowners’ Association’s hurricane loss. The insurance company originally denied the claim and then offered only $250,000 before our firm stepped in.

Our Miami based attorney, Eddy Franca, won a settlement of $200,000 for a Homeowners’ Association’s hurricane damage claim. The insurance company originally denied the claim. Eddy was able to secure an awesome settlement for our client!

Our personal injury team won a settlement of $293k for three clients involved in a car accident.

Our personal injury team represented four clients involved in an auto accident and secured a $300K settlement for their injuries.

Our Miami based attorney, Eddy Franca, won a settlement of $900,000 for a Homeowners’ Association’s hurricane loss. The insurance company originally denied the claim and then offered only $1. Eddy was able to get our client the amount they deserved!

Our Louisiana team represented a commercial real estate agency who suffered extensive damage after Hurricane Ida. Due to our aggressive negotiation skills, we were able to secure our client an appraisal award of $4.6 million.

Our Louisiana team represented a hotel who suffered wind, water and structural damage after Hurricane Ida. Our experience in property damage disputes allowed us to fight for our client to secure a settlement of $2.5 million.

Our trial team represented our client who suffered damage caused by Tropical Storm Eta. After the insurance company denied the claim, our team opposed it and convinced the jury that the Tropical Storm Eta winds damaged the property, entitling our client to a full recovery.

Our personal injury team represented a client who was involved in a rideshare accident. The insurance company initially offered only $25k, but our team was able to get our client the money he deserved for his injuries.

Our personal injury team secured a $300,000 settlement for a client involved in an automobile accident. Our team got the $300,000 settlement despite the insurance company only making an initial offer of $50,000.

Our personal injury team secured an $800k settlement for three clients involved in a car accident.

Our personal injury team secured a $1.13M settlement for his client who was involved in a motor vehicle accident with life-altering injuries.

” I have nothing but positive things to say about Morgan Law Group. Specially Laura that helped me out through the fast and easy process. “

” I am extremely happy with the assistance from Morgan Law Group. They made my journey with them easy and efficient. I was kept informed of the progress every step along the way. Many thanks to them. “

” They were great and were very professional. Kept us up to date through the whole process. “

” Amazing experience working with The Morgan Law group. Everyone there was very nice and professional. They made my personal claim feel like it was being handled by family. I look forward to recommending them and using them in the future. “

Meet Our Attorneys

Our team of attorneys at The Morgan Law Group is committed to providing personalized and aggressive representation to our clients. We have years of experience handling property damage claims, personal injury matters and business litigation disputes.