At The Morgan Law Group P.A., our Louisiana, Mississippi, California, Puerto Rico, and Florida insurance claims attorneys know that insurance companies count on a simple misstep by homeowners to avoid paying the total value of their insurance claims.

Whether your home has suffered hurricane, flood, or fire damage, if you do not have an inventory list, images, or overall proof of the contents that were damaged, the insurance company can deny coverage for those possessions.

That is why we recommend all homeowners keep an updated inventory of their property and its contents.

A simple inventory list can speed up and maximize your insurance claim, since you know exactly what was lost, and its overall value.

Here is how you can make the most of your list.

What Should Be Included in a Home Inventory?

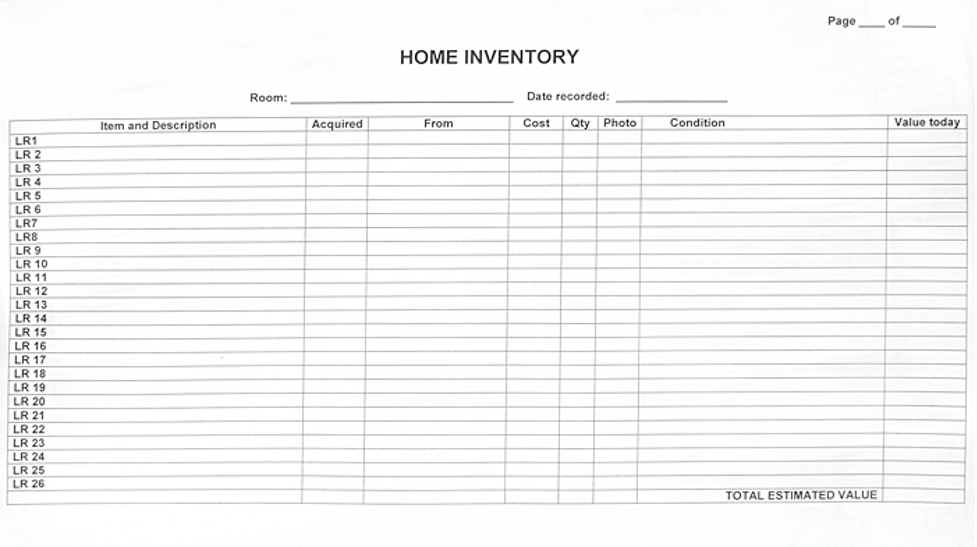

A proper home inventory should include the following information:

- Descriptions and images of all items

- Purchase dates and the stores where they were purchased

- The makes, models, and serial numbers

- Estimated values of the items

- Receipts

A home inventory can be as simple as a written list, pictures, or video, a Word or Excel document, or through an app. The National Association of Insurance Commissioners recently launched a home inventory app that can help speed the process by scanning barcodes for accuracy, grouping possessions by category, and storing images with ease.

The key is to be as detailed as possible and to store a copy of the inventory outside your home or in the cloud. Be sure to update the inventory often, so new possessions are included with each purchase, and other items are deleted when they do not apply any longer.

Contact Our Skilled Insurance Claims Attorneys at The Morgan Law Group P.A. for Help With Your Claim

While an inventory list can help with your homeowner’s insurance claim, your provider is not simply going to write a blank check to reimburse you for your damages. Contact our experienced insurance claims attorneys by calling 888-904-2524 to schedule a free consultation and learn how we can help you pursue the outcome you deserve from your insurance policy.